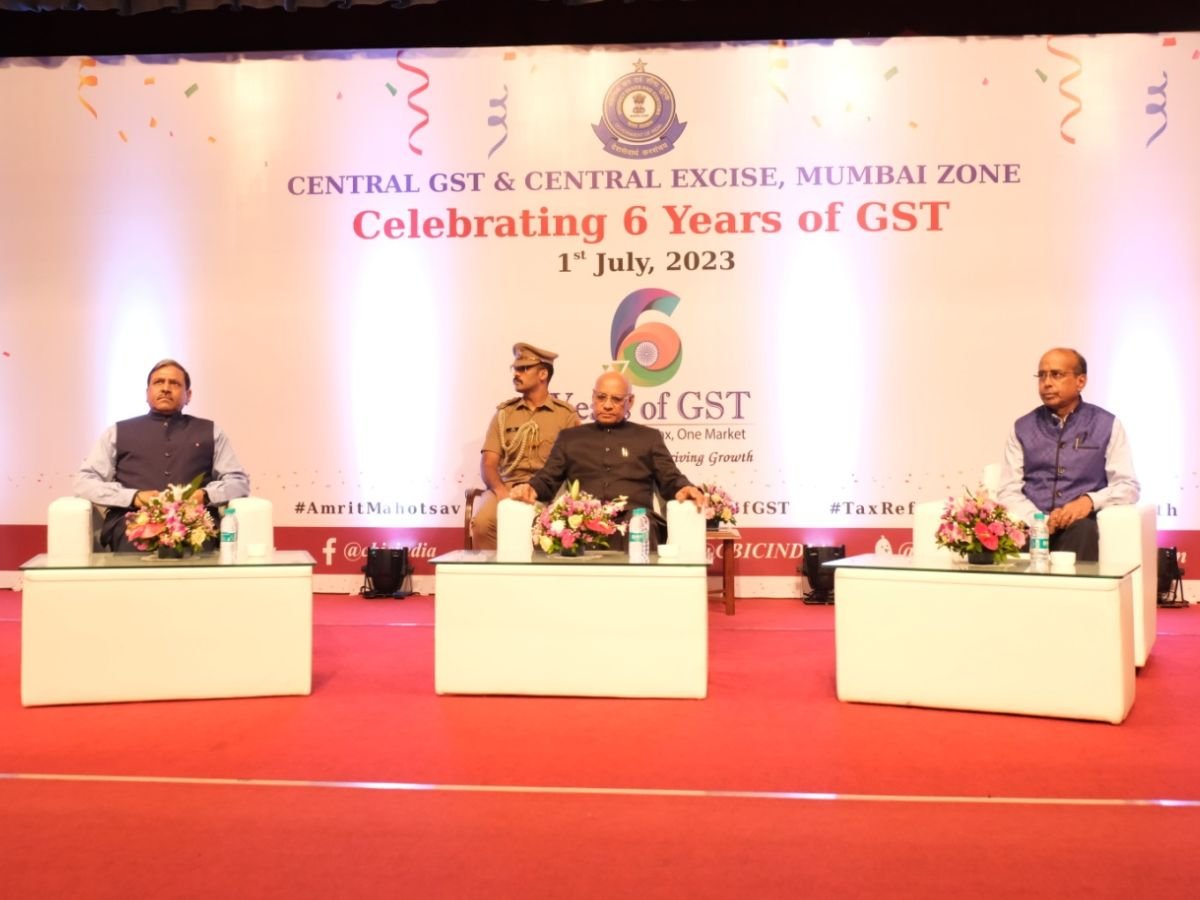

Mumbai (Maharashtra) [India], July 5: Mumbai CGST & Central Excise Zone celebrated the 6th GST Day on 1st July, 2023. His excellency Hon’ble Governor of Maharashtra, Shri Ramesh Bais graced the occasion as the Chief Guest of the event. Officers and staff from Mumbai CGST & Central Excise Zone, officers of Mumbai Customs, and Maharashtra State GST, as well as taxpayers were present.

Speaking on the occasion, The Hon’ble Governor of Maharashtra, Shri Ramesh Bais expressed pride and honor in celebrating the 6th anniversary of the Goods and Services Tax (GST) in India. He highlighted GST as a historic and revolutionary change in the country’s indirect tax system. He emphasized the need for GST to overcome the shortcomings of the old tax system, which had multiple taxes and complexities. Further, he praised GST for promoting cooperative federalism and reducing corruption and tax evasion. He also emphasized that the GST reflects the values and aspirations of the country and is a tax that powers the building of our New India. He noted that the GST Collections are buoyant and consistent and stated that the tax collection by the Mumbai GST zone has crossed Rs. 87,500 crores, and that of Maharashtra State GST has crossed Rs. 41,462 crores in 2022-23. In conclusion, He called for a commitment to making GST more efficient, effective, and equitable.

The Principal Chief Commissioner (CGST & Central Excise), Mumbai Zone, Shri Pramod Kumar Agrawal expressed that the GST day is a means to celebrate the 3Cs, i.e., commitment to taxpayers, cooperative federalism, compliance reduction. He emphasized that all the four business processes of GST, i.e. Registration, Return-filing, Payment, and Refund, have been completely digitised , in line with the Hon’ble Prime Minister’s vision of GST being a Good and Simple Tax. He further mentioned that the officers of the GST have fulfilled the principles of Reform, Transform, and Perform. He also informed about the success of the recently held Grievance Redressal Committee Meeting by the Member, CBIC, the Chief Commissioner and the State GST Commissioner.

The Chief Commissioner (Retired), Dr. D. K. Srinivas expressed his gratitude towards the taxpayers for their support and cooperation. He stated that the immense success of the GST in the last six years has proved all the sceptics wrong. He further highlighted that the success of the GST is evident from the fact that various independent surveys have clearly shown that more than 90% of taxpayers are satisfied with the GST regime.

The Principal Commissioner Shri U. Niranjan highlighted GST as a transformative tax reform that has simplified, unified, and modernized the country’s indirect tax system. He emphasized the benefits of GST, including widening of the tax base, creation of a common national market, and providing relief to the poor and vulnerable sections of society. He mentioned how GST has facilitated the seamless movement of goods and services, reduced barriers to trade, and attracted domestic and foreign investments.

The Principal Commissioner Shri Nirmal Kumar Soren delivered the Vote of Thanks, expressing gratitude to the esteemed Chief Guest, Hon’ble Governor of Maharashtra Shri Ramesh Bais, for attending the event and sharing words of appreciation. He also thanked other distinguished guests including officials and staff of the CBIC, representatives from the trade, awardees, taxpayers, and the media fraternity, for the successful conduct of the Sixth GST Day commemoration.

On the occasion, commendation certificates were also presented by Hon’ble Governor to 10 officers of the Central GST who have contributed to the successful implementation of the GST for their continued devotion and commitment to duty. The event also involved felicitation of major taxpayers from Mumbai Zone, which included Mahindra & Mahindra Ltd (Award received by Shri Ravi Poojary Head-Indirect Taxation), Bharat Petroleum Corporation Limited (received by Shri G. Krishnakumar, CMD), Deposit Insurance and Credit Guarantee Corporation (received by Shri S Sathish Kumar, General Manager), General Insurance Corporation of India (received by Shri Devesh Srivastava) in the GST category, and Hindustan Petroleum Corporation Limited (received by Shri Avinash Dixit, CGM) and Oil and Natural Gas Corporation (received by Director Finance, Ms. Pomila Jaspal) from the Central Excise category.

Two taxpayers, namely, Ji Shoji India Pvt. Ltd. and Rajan Agro Green Foods pvt ltd also received commendation from the MSME category.

The occasion also witnessed experience sharing by the representatives from trade and industry. The President, ASSOCHAM Maharashtra, Mr. Shantanu Bhadkamkar talked about how the transition to GST was smooth in comparison to other countries and the contribution to GDP was upto 1%, which was a significant figure. The President, Maharashtra Chamber of Commerce, Mr. Lalit Gandhi commended the proactive support provided by the GST officials to the trade and industry. Mr Amit Dave from ICICI Bank emphasised how GST has resulted in true democratisation of credit.

This story is released by Satish Reddy from World News Network

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.